Salary preparation is one of the main functions of HR, and it must be carried out on a monthly basis as part of business operations. It has many subtleties to deal with, whether it is collecting information to work. Taxes and related documents As a company grows, the burden on HR increases.

There are now alternative ways to assist your organization with complex payrolls. The most popular are payroll software and payroll service, both of which have different pros and cons. Is there a way to know which solution is best for your organization? We have compiled the differences between the two services to help you choose which one is right for you. This article will assist you in making an easier decision!

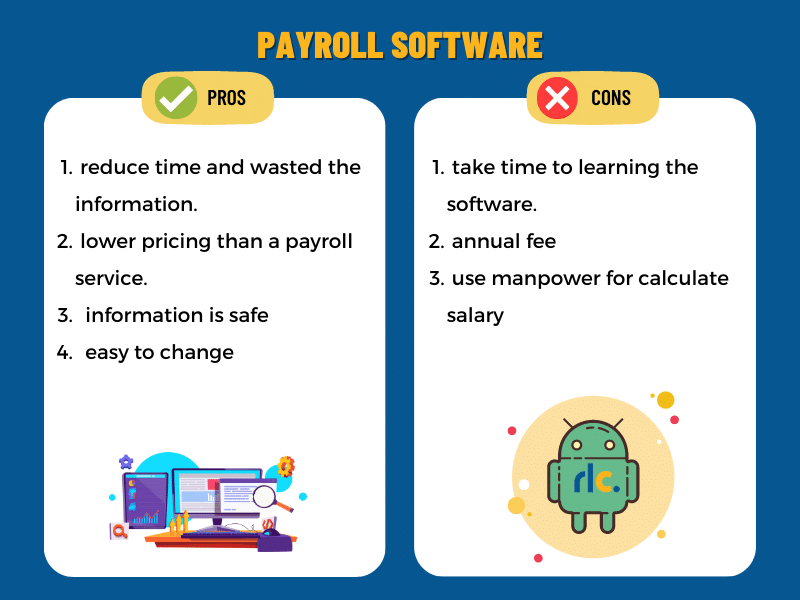

Payroll Software

In order to manage salary and wage information more efficiently, it is a very helpful tool. Reducing manpower usage by responsible for all aspects of the process, including data import, payroll calculations, taxes, and issuing related reports.

Pros

- Time Saving: In the past, it was time consuming to search for data using force. The cumulative workload may not be able to be completed in time for salary issuing, which is quite close. Therefore, payroll software help collect information about everything related to finances. It doesn’t matter how long or how many data is in the company, and it’s easy to summarize the results instantly.

- The cost is cheaper than payroll service: The most payroll software come with licenses that can be purchased annually. In this way, budgets are controlled and costs are reduced. Depending on the organization’s size and complexity, using a payroll service may be more cost-effective for an organization that has a complex salary calculation process.

- Your confidential information will not be tampered with by third parties: So you don’t have to worry about them. This program is only for company owners, supervisors and HR employees. This must be approved by another eligible individual and must be performed in the office only.

- Easy to transition: Through the platform, the management team can access payroll operations and customize the software as needed. In contrast, businesses that use payroll service need to contact the service company to make changes to any of their processes. This may require a longer turnaround time for major adjustments. The advantages of internal payroll software include quick fixes

Cons

- Take a lot of time by the beginning: Implementing payroll software in the organization can be difficult for employees to understand: Some HR people will have to take time to learn more about the software in order to be able to use it efficiently.

- Annual fee: There is also an annual fee associated with some payroll software. It is also referred to as a value M/A (Maintenance Service Agreement), so the user must also take this into consideration when evaluating the overall cost. But when comparing prices and features, it is a worthwhile option for the organization.

- The salary calculation requires manpower: One of the disadvantages that many people find most frustrating is that calculating salary requires manpower. If your business is large and complex in calculating payroll. If your payroll employee resigns, you can prepare (tired) to find new employees. And it goes back to the first limitation mentioned, that new employees need time to learn how to use the software as well.

Who is suitable for payroll software?

- Organizations that want to reduce complicated processes can use this program because it manages everything at every step of collecting, calculating, and summing up the results. This allows for more accurate and timely information, as well as the ability to issue slips and report payroll results correctly and with high precision.

- Organizations that want their internal information to be secure Because there is a limit to the rights of those who have access and can use it. Additionally, you can check who has entered the payroll software again. This makes sure that confidential information isn’t leaked, nor is it easy to disseminate to others.

- Organizations that need financial calculations related to payroll in various areas Can have many functions such as salary calculation, calculation of daily wages, weekly wages, social security and tax calculations, etc. It feels like you have a right hand assistant with a high level of accuracy that makes managing various tasks a lot easier. It makes the work much easier.

- The organization can choose whether to use it short-term or long-term. without any obligation, therefore limiting the budget available.

- Large organizations and many employees, which of course is a matter of thinking and calculating, payroll management including things related to the welfare of employees that need money to be involved, payroll program required to be able to manage data more efficiently and accurately.

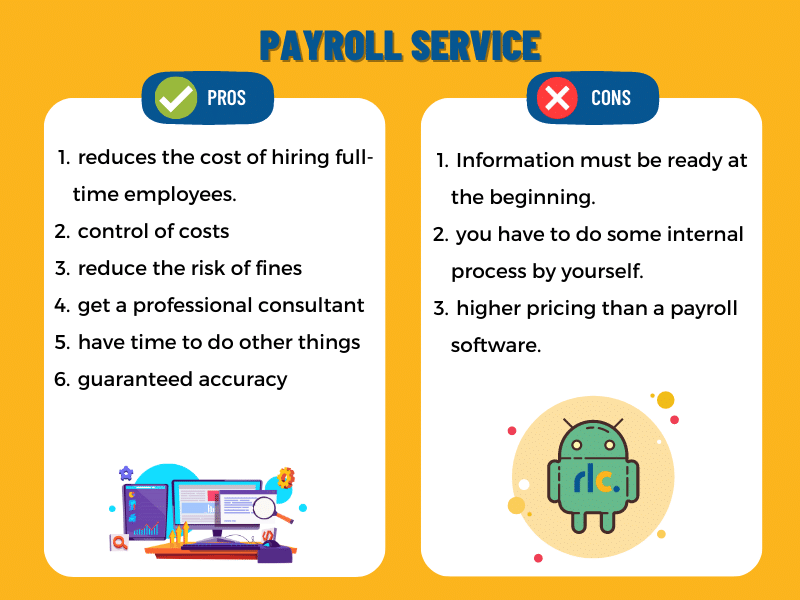

Payroll Service

It is the responsibility of third parties to provide payroll services. Payroll service provider assists in making payroll systems and acts as a consultant. They have expertise in making payroll systems and can take responsibility for this part effectively. They are a helper to make payroll easier. Without the organization having to do it themselves to cause headaches

Pros

- Reduces the cost of hiring permanent employees: because permanent employees often have certain costs, besides salary, that executives or business owners may forget to consider, such as bonuses or other additional benefits. You don’t need to pay any of these things to the service provider if it’s a service to receive salary. You only pay a service fee to the service provider.

- Cost Control: You can control expenses by setting the length of time you want to use payroll services.

- Reduce risk: In the event of a lawsuit, employees without adequate expertise may lead to fines for the company. – Reduce the risk of fines: payroll matters are very sensitive. An expert in this field will come in and ensure that everything runs smoothly and legally.

- Get a professional consultant: Gathering all-round experts to manage payroll effectively is a good opportunity to receive advice and consultation for the organization to be able to apply it in the future to develop and advance even more.

- You have more time to do something else: no worries about the fuss. Salary preparation can be quite a headache. It’s something that needs to be done every month, and often when urgent work comes in. Hiring a payroll service will allow you to reduce this concern. You don’t have to deal with fussy tasks. You can focus on developing your business or other core tasks because experts handle everything.

- Accuracy is guaranteed: With modern data collection and calculation systems, as well as an experienced payroll inspector.

Cons

- It takes time to get the information ready at the beginning. This is because you have outsourced the management of some matters within your organization. It is necessary to learn the work processes of that organization as well. Therefore, relevant information must be prepared, such as documents, salary information of employees, etc. However, in most cases there is always a fixed timeline for payroll service work. So it’s definitely not a waste of time. Being able to manage payroll information efficiently throughout the employment period is definitely worth it.

- Have to manage some matters themselves, although payroll services will be responsible for managing the salary to be fully worth the wages, however some matters The organization has to handle it themselves because it may be confidential information that should not be shared with anyone except HR and management. However, there are not all disadvantages. Since in the end, different confidential information should be managed by organization, as before.

- The price may be higher compared to payroll software.

Who is suitable for Payroll service

- Organizations that need payroll professionals to help manage payroll, provide advice, and improve what exists to make it better than ever.

- Organizations that want to manage various aspects within a more systematic manner

- Payroll calculation is complex in organizations.

- There is a fixed term of employment for payroll services, which allows a company to control expenses in this part.

Summary

Reading up to this point, many people will likely already be familiar with the discrepancies between payroll software and payroll services. Choosing which one works best for your business depends on several variables that must be taken into account when making a decision; factors such as security, accessibility, budgetary constraints and employees’ level of experience in payroll management.

If you’re unable to decide which service is right for your organization’s needs, please feel free to contact us for advice and consultation from a dedicated specialist!

SEO Specialist and Client Success at RLC Outsourcing