Individuals need to earn how much before they are required to pay taxes? Updated 2024

One of the responsibilities of citizens with an income is to pay taxes. Generally, the filing period for individual income tax is from January to March, with the option to file taxes at the Revenue Department’s office or online through the Revenue Department’s website until the end of April.

However, before filing individual income taxes, many may wonder if their income reaches the threshold requiring them to pay taxes and how much tax they would need to pay. Today, we have the answer for you included sharing the tax calculation in Thailand

Net Income Per Year and Income Tax Rates

For individuals with different net incomes per year, there are varying income tax rates as follows:

-

- Net income per year 0 – 150,000 baht: exempt from tax

- Net income per year 150,001 – 300,000 baht: 5% income tax rate

- Net income per year 300,001 – 500,000 baht: 10% income tax rate

- Net income per year 500,001 – 750,000 baht: 15% income tax rate

- Net income per year 750,001 – 1,000,000 baht: 20% income tax rate

- Net income per year 1,000,001 – 2,000,000 baht: 25% income tax rate

- Net income per year 2,000,001 – 5,000,000 baht: 30% income tax rate

- Net income per year 5,000,001 and above: 35% income tax rate

How to Calculate Personal Income Tax

The calculation of personal income tax must use two methods in parallel and then choose the method that results in a higher tax. The methods for calculating taxes are as follows:

-

Progressive tax rates in Thailand,

applicable to both Thai and foreign individuals, calculate tax from net income, or what is called progressive tax rates. This is determined by net income per year and the income tax rates mentioned above, which increase progressively.

The calculation is as follows: Net income = Income – Expenses – Tax deductions Tax payable = Net income x Tax rate -

Thailand Lump sum tax calculation method,

for income from sources other than salary, requires a lump sum tax calculation of 0.5%.

This is calculated using the equation: Tax amount = Non-salary income x 0.005 This method calculates income from all sources other than regular salary, where if the calculated tax does not exceed 5,000 baht, it is exempt.

However, this method is applied if the calculated tax exceeds 5,000 baht, implying that the total income from sources other than salary must exceed 1 million baht per year, or if the lump sum tax calculation results in higher tax than the progressive rates.

-

Simplified tax calculation summary in Thailand:

To determine how much tax is due based on income, first calculate the net income per year from the salary. Then, compare this net income figure to determine the progressive tax rate.

If there is additional income beyond salary (Type 1 income), calculate the tax at a lump sum rate of 0.5% of the total income from all other sources. Finally, compare the tax amounts from both calculation methods, and choose the method that results in higher tax liability.

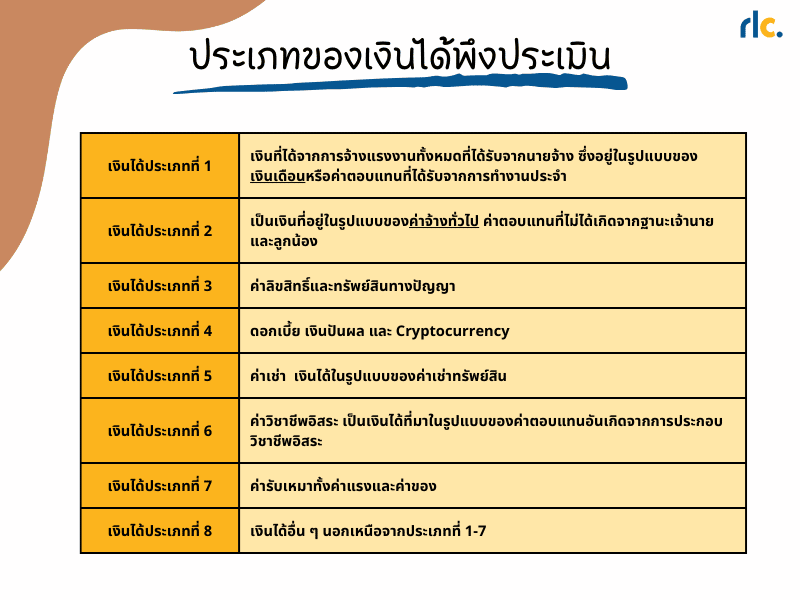

Types of Assessable Income in Thailand

Since everyone has different occupations, income has been categorized into groups to ensure the most fair tax calculation possible. The types of income subject to tax are as follows:

- Salary (Type 1 income): Money received from employment, including salaries or compensation from regular work, as well as any property or benefits received from an employer as a result of employment.

- General compensation (Type 2 income): This includes general wages, commissions, compensation not arising from an employer-employee relationship, money, property, or any other benefits received due to duties or positions held.

- Royalties and intellectual property (Type 3 income): This encompasses royalties, goodwill fees, or intellectual property, including annual income derived from wills or other legal acts that require the recipient to pay personal income tax.

- Interest, dividends, and Cryptocurrency (Type 4 income): Income in the form of interest, profit-sharing, dividends, and earnings from similar sources.

- Rental income (Type 5 income): Income from renting out property, including money or other benefits derived from leasing property, breaches of lease-purchase agreements, and breaches of installment sale contracts.

- Freelance professional fees (Type 6 income): Compensation from practicing a freelance profession, which varies in amount, including law, engineering, medical practice, architecture, fine arts, accounting, or other professions specified by royal decree.

- Contractual work including labor and materials (Type 7 income): Income from contracting work, both labor and materials, or supplying equipment beyond tools.

- Other income beyond Types 1-7 (Type 8 income): Income not classified under Types 1-7, such as earnings from businesses, real estate sales, transportation, or other sources not covered in Types 1-7.

Examples of tax calculations in Thailand based on salary income (Type 1 income):

- A is single with a monthly salary of 26,580 baht.

- Annual net income: 26,580 x 12 = 318,960 baht

- Deductions: 60,000 baht (fixed general expenses) + 100,000 baht (50% of income but not more than 100,000) + 9,000 baht (social security) = 169,000 baht

- Net taxable income: 318,960 – 169,000 = 149,960 baht.

Therefore, with a net annual income of 0 – 150,000 baht being tax-exempt, Mr. A does not have to pay any tax.

- Miss B is single with a monthly salary of 27,000 baht.

- Annual net income: 27,000 x 12 = 324,000 baht

- Deductions: 60,000 + 100,000 + 9,000 = 169,000 baht

- Net taxable income: 324,000 – 169,000 = 155,000 baht. The first 150,000 baht of the net annual income is tax-exempt, and the remaining 5,000 baht falls into the net annual income range of 150,001 – 300,000 baht, which has a 5% income tax rate. Therefore, Miss B would have to pay a tax of 5,000 x 5% = 250 baht (monthly tax of 20.83 baht).

Summary

Individuals with an annual net income exceeding 150,000 baht must pay taxes according to the specified rates. Taxes can be filed from January 1 to March 31 of every year at the nearest Revenue Department office or through online channels.

SEO Specialist and Client Success at RLC Outsourcing